1

At seven o 'clock in the morning, from the south bay the Caltrain commuter train to San Francisco to find a location, it is not so easy.

As the main means of transport in silicon valley, Caltrain all the way up north, passes through in mountain view, palo otto the famous "science and technology city". The car early in the morning, many people open the computer started a day's work. One and a half hours after arriving in San Francisco, who walked out of the station, Soma area into San Francisco -- here ten years ago or old factory, has now been startups and occupied.

Engineers are in San Francisco, expensive business, instead of traditional silicon valley, where the rest are Google, apple, the big companies. Those who make their homes in the silicon valley engineers need to work north of San Francisco, according to official figures, since 2011, Caltrain on the number of people is growing by 10% each year.

Entrepreneurial boom to San Francisco office becomes popular. Now, if you want to rent an office in San Francisco, most of the lease for ten years, and even silicon valley's most famous sand dunes road lease generally is only 7 years. GGV capital venture capital company moved the new office in the sand dunes on the road, the new lease, the lease is still seven years from 2007 to sign the lease.

In addition to the 10 year lease, proud of San Francisco landlords are more willing to rent the house to A round of financing company. Famous silicon valley venture capitalists Boris Wertz said on Twitter blackout, San Francisco, landlords and even ask to see the door asks the company letter of intent for A round of investment.

This of course means higher cost. "At least we have to pay 40% more for this cost. A silicon valley incubators InnoSpring, king said laughing, head when doing angel round investment need to accounting cost, calculated according to every engineer in $100000 a year before, and now a single engineer cost up to $180000, "in addition to the rent, the engineer's salary is high also. San Francisco is $5 for a cup of coffee, and the bay area is 3 blocks".

In San Francisco, entrepreneurship has become so common that you can in the Soma area to buy some coffee shop said "congratulations on your won A round of funding" postcards.

Investment people can't refused to pay. In the traditional sense of the science and technology enterprises does not include the San Francisco area in silicon valley, and from the perspective of the data of vc institutions, such as Anglelist, now they are in the bay area (collectively) to silicon valley area, and San Francisco investment, 70% have landed in San Francisco.

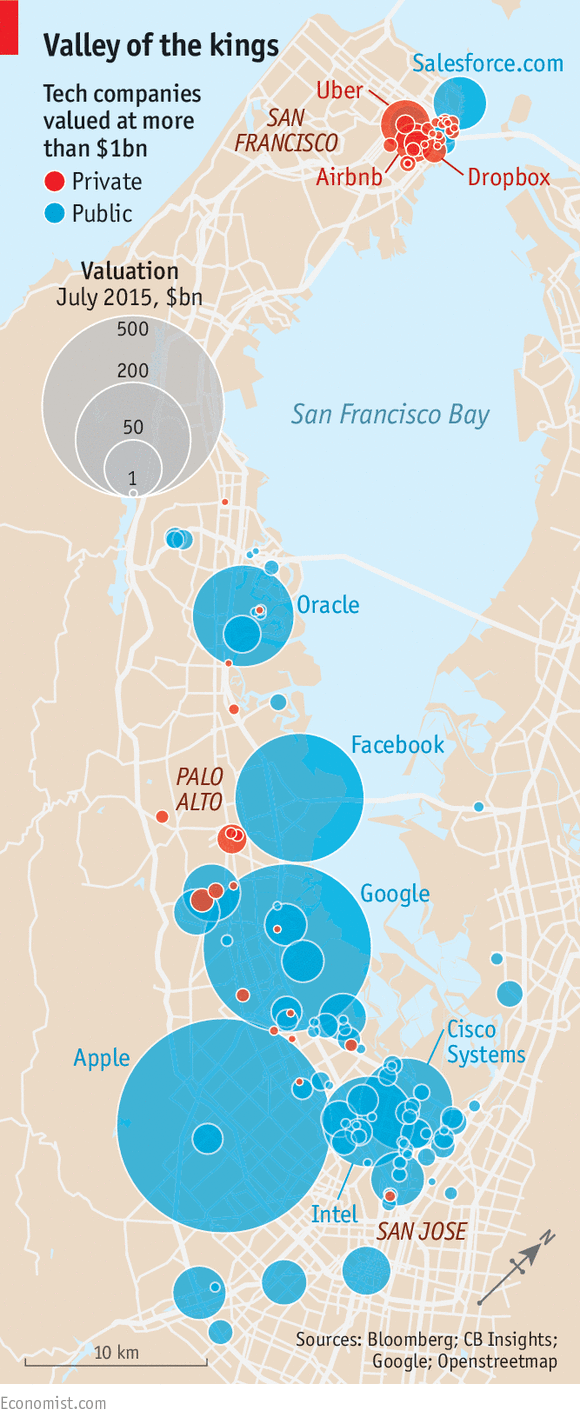

"As long as the end result is a company to do it's no big deal." Tung GGV capital partners on interface reporters, "unicorn", after all, that those who are in San Francisco, now the hottest Uber here, Dropbox, reality and Twitter and Square are all grown up here.

2

It often let people worry that bubble. Benchmark Capital partner Bill Gurley has been warned, "this group of people don't know what call 'fear'." , he says, more and more people are working for money-losing company, the number of unprecedented.

These people do not know fear include some strangers in silicon valley - from China. King smile management of incubator Inno Spring founded in 2012 by the Chinese, in 2015 after the Chinese New Year, Chinese people visited the incubator. "I have never seen those people, inquire about, A lot of people in the a-share stock market to make money." These people, "the king laughed earned with quick, hope to be able to in a few months can quickly doubled, as a matter of fact, this is unlikely to be in the United States.

A shares in the first half of this year popular, local Chinese entrepreneurs in silicon valley is better than other entrepreneurs find the money. King smile to know some Chinese Facebook engineer leave business, even if there is no molding ideas, many of China's capital after the door to investment. "A lot of investors to some Demo day, see the company vote, silicon valley start-up are spread, China's good money, get a Chinese." The king replied.

Just recently, a huge sum of money from China into the valley. AngleList is San Francisco famous angel investment agency, on October 12, the company announced that received from the investment of $400 million of the division in China's listed companies, the future will be at startup. Founder AngleList Naval Ravikant has to emphasize, the money will not cause bubble.

But some people worry about this. "This may allow the cats and dogs can get the money." Who said, in capital cases, some business and business plan should not be get chance.

In early investors, especially when the market hot, always filled with a kind of "the fear of missing out on" emotions - even if it is wrong. Tung is millet early investors, there is no doubt that this is a successful investment, for investors, a successful investment, let them have the capital to dabble in a broader project early. "Important whether companies are involved in the early investment focus, even said, but they were afraid to wince, particularly high eventually missed a controversial company." Who said, "because of the high speak white controversial company is more expensive."

From the seed investment from the beginning, some companies began valuation growth path, many company's aim is to become "unicorn" - valuation of more than $1 billion. In November 2013, the Cowboy Ventures, founder of Irene Lee (Aileen Lee) in a blog TechCrunch word is proposed.

The unicorn originally refers to the "god beast", a rare but are everywhere now. In the past 10 years, fewer than 40 unlisted companies reached a threshold. And according to the Wall Street journal, the latest statistics, the number of the unicorn company now has reached 123 (as of October 14), valuation of the sum of $468 billion.

"There is no doubt that now is a peak. Tung said, before the bubble burst real, no one can conclude if there is a bubble, but there is no doubt that now is the time to the highest price.

People are willing to open a small check as seed round of investment, but then turned cautious. Than seed round of tens to hundreds of thousands of dollars in investment, mid late project funding to demand, but because of the frenzy of investment since 2014, some projects of the weak of the heavenly bodies first got the money, make follow-up investment risk is bigger.

Investment of the late project becomes a safe-haven. Tung's GGV capital involved in the reality of 2015 E round of funding, "this is something we all had the most late in the project, also is the highest one." Tung early investment involved with many famous companies, including payment platform, Square, furniture decoration BBS Houzz, and Wish multinational electricity supplier, sports bracelet misfit is now unicorn famous member of the club, in addition, he also participated in millet and ali's early investment.

Round on reality, he admitted, they hesitated, but finally decided to vote this year, "I can't tell how much you specific prices rose, but from last year to this year, the industry more than doubled in price."

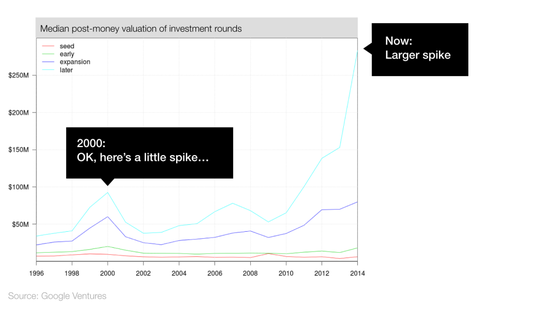

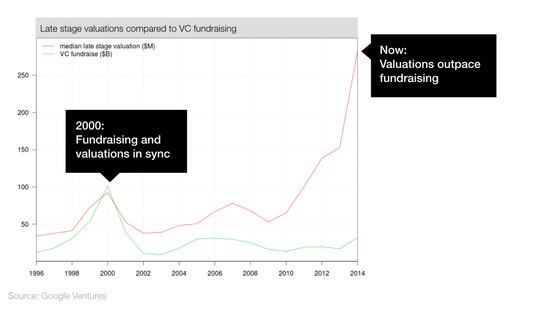

According to Gooogle Venture data, compared with 2000, 15 years ago, the seeds of Venture project valuations round flat, but valuations reached a new peak in the late, nearly three times the level of 2000.

"A lot of VC captured for the first time after don't want to go to see, I don't agree with this view, I think you want to see how much it can do, if can do big enough should keep shooting." He said, "like Uber or like someone whose company is not much, but as long as the business globalization, future growth space is big."

Who participate in the reality through the first round of funding, E valuation to $25.5 billion, valuations are ranked third in the unlisted companies, and in front of it was valued at $51 billion after F round Uber and valued at $46 billion after the first round of funding F millet.

They will be able to receive money from private markets continuously. Uber valued at $7.4 billion in financing, financing credit ranking first in the unicorn company, and also the drops quickly drop $16 billion valuation financial in unicorn company for $4 billion to become the second higher credit line of the company.

One obvious trend is open market financing is replacing the IPO. Generous venture capital for the company to keep "non-public". According to the data provided by the the Wall Street journal, by the middle of September 2015, the new listed companies in the United States, the technology company only account for 11%.

For startups, of course, this is a good thing.

"Many startups still has a lot of business to do, he didn't want to spend time on it. In addition, the listed company to a lot of obligations, the law on the legal regulation of listed companies is more and more, so you have to spend a lot of time to do research, not every company is willing to take the time to do these things." Who regard that the company is not listed, only in the face of risk investment professional investors, is more easy.

Another important reason is that these companies on the open market is not necessarily can get such a high valuation. Alibaba before listed by Wall Street, and from last November, up to now, market value has shrunk more than 40% than listed.

Meanwhile, the entrepreneurs crazy money situation has changed.

Those who are ready to early and mid financing entrepreneurs are suffered. A female entrepreneurs to Tracy Lawrence in San Francisco runs A company Chewse room service for the enterprise, began to prepare A round of funding from A year ago, has nothing, until A year later, in August 2015 to successful financing of $5.9 million, the company annual income reached 4 million us dollars.

"Two years ago, less than $2 million in revenue of the company can easily financing, but by now, 4 million finance income is so difficult." King said laughing, she was able to observe is that the early and mid financing into a relatively difficult period.

3

If the bubble, no one knows how far is from burst its tip.

But experienced people remember bubble burst in 2000. The nasdaq falls as if to let a person back to the Wall Street crash of 1929 s, a total loss of more than 60000 one hundred million yuan, in silicon valley someone watching all personal fortune in a few months.

Silicon valley as a mature business community, the genius of foam and winter wary in them. "We don't know when winter will come, so we will advise our by firms in the second half of this year as money prepared for winter." Tung said.

Narrowing the financing amount is one of the methods. A company named Mailtime is to provide new startups to the Chinese mail service, in the first half of this year in preparation for A round of funding, originally found difficult than imagined, they immediately narrowing the financing scale, turn A round into the Pre - A. "We also found that raise A round may not so fast, first round, there are some money to go through this period of time is better." Founder huang said. Because is A Chinese company, their contact is mostly Chinese background of investment in the wind, but found in financing, this round of financing before June a-shares tumbled over, there is no doubt that they made the right choice.

The National Venture Capital Association (National Venture Capital Association, said the new ventures in the United States in the fourth quarter of 2014 to raise the risk of Capital than any of the past 13 years quarter - if the bubble eventually come in the future, it can be seen as preparation before winter.

Danger signal is constantly emerging. From the perspective of the data of Google Venture, until the end of 2014, the investment in gold wind raised far below company valuations rise. At the same time, the late to venture out of gold rate since 2009, all the way down - very few listed companies. This means that, perhaps, risk investment of ammunition is not adequate as the imagination.

Technology companies is extremely low, the number of ipos means no exit channel risk investors.

"This means that the bubble is worse than in 2000." Mark Cuban is the mavericks, the boss of the NBA, and successful entrepreneurs in silicon valley, "in 2000, people everywhere are talking about buying and selling stocks, hundreds of companies listed, people can easily buy and sell." , "he said." even when stock prices have been falling, or anyone can predict in advance to that situation and exit ahead of time, but now people don't have a chance to buy and sell."

The last few months before the dotcom bubble burst, he founded Broadcast.com sold for $5.7 billion. Cuban recently is constantly emphasize that there is no doubt that silicon valley is facing another tech bubble, this also will keep pace with The Times the tech bubble, if really burst the bubble, many people will be devastating blow.

There may be an accidental event called the bubble of needlepoint, such as the death of a unicorn company, or a public failure. Pay Square finally handed in public files, the $6 billion valuation of the company to choose listed in turbulent time. Now the market is not optimistic, in October, has been listed technology companies, according to the Wall Street journal reported, payment processing company First Data Corp. IPO pricing below expectations. Square such dimension listed companies maybe silicon valley will affect wind direction.

Not everyone think there's a bubble, "the wave are higher than any now, but if the population increasing every wave of price will be higher." Who believes that prices higher than any previous bubble, doesn't mean that there must be a bubble, "Internet users now much more than a decade ago, and a growing number of Internet companies is based on global development". In 2000, the number of Internet users is 400 million, and is now 3.2 billion. "

Of course, also some people waiting for bubble burst. New York times columnist wrote Farhad Manjoo, San Francisco and the bay area residents expect bubble burst, it means that programmers wage income is reduced, so that the local prices, supermarket prices come back smoothly.

Some entrepreneurs and venture capital also is not afraid of bubble burst. "Burst, in addition to the first and second industry of the company's money, the other may be difficult to harmony, competitors can't melt money and rich company can efficient to spend money, what's wrong?" Tung said, bubble is a good thing for a good company.

For investors is no bad thing. "Bubble broken tung said, apparently for investment is good, price is low, because everyone has actually experienced after two or three process would not be so scared."

Chinese entrepreneurs need not panic bubble in silicon valley. Than americans just experienced the dotcom bubble burst in 2000, Chinese companies and maturity of the Chinese capital has had two bubble burst and entrepreneurial winter.

In 2000, the famous American bubble burst, very few Chinese Internet companies and capital. But after potatoes on the market in the United States in 2007, local IPO market for Chinese companies closed down nearly 24 months, and in 2011 and 2012 for any shares in, is also a recession and the cold winter. "Everyone has matured," he said, the most important thing is to know how to deal with

。